From Ocean Currents to Zero-Carbon H2: Economics of Floating Offshore Wind to create Green Hydrogen

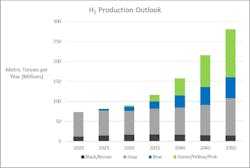

Highly publicized forecasts indicate that there will be massive long-term growth of hydrogen production, in particular hydrogen made by using electricity from a renewable energy source to electrolyze water, or split water into hydrogen and oxygen.

Most people use the term green hydrogen to mean hydrogen produced using solar or wind power, as opposed to black, brown, gray, blue, and yellow hydrogen, which use black coal, lignite, natural gas, natural gas with carbon capture and sequestration, solar, and nuclear power, respectively.

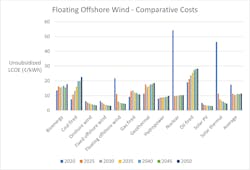

According to most analysts, green, blue, yellow and pink hydrogen, collectively, will experience massive per-kg cost decreases by 2030, based on economies of scale, standardization, and digital technology. The prevailing consensus assumes that the Levelized Cost of Energy (LCOE) of green hydrogen will drop from nearly $100/MWh to about $40/MWh by 2050, and the price decrease will stimulate a corresponding increase in green hydrogen production (from essentially zero today).

Black, brown and gray hydrogen prices are largely assumed to remain flat, as those technologies are well-established. Blue hydrogen is expected to decrease progressively in cost due to improved methods for carbon capture and sequestration.

Many developers and some governments are aggressively building offshore floating windfarms as a power source for some of this green hydrogen, premised upon these assumed cost reductions.

Aker is targeting a 62% reduction of floating wind costs by 2030, through economies of scale from larger projects and equipment, standardized equipment and processes, and smart sensors and condition monitoring. It expects its LCOE to drop from 14.4 cents/kWh in 2022 to 5.5 cents/kWh in 2030.

Aker Offshore is working with South Korea, whose government has targeted 6 GW of floating wind by 2030. ODE is targeting a demonstration in 2024, dubbed the Dolphyn Project. It is a joint project with Doosan and Tractebel.

The Scottish government has placed a big bet on offshore wind development, including floating wind, based on these cost reduction forecasts. It has recently auctioned off the rights to 7,000 square km of seabed for projects totaling 25 GW of generating capacity (the program is dubbed ScotWind). Floating wind figures prominently in these plans. BlueFloat won ScotWind awards for Orion (500MW), E1 (1,200 MW), and NE3 (1000 MW). RWE, Orsted, Ballard, Doosan, Siemens, and Lhyfe are also working on offshore floating wind projects, and Iberdrola claims to have a pipeline of floating wind investments in 11 countries.

If the cost gains are realized, the dramatically lower cost could drive massive growth. Green hydrogen could scale to nearly half of all production between 2030 and 2050. Assuming half of offshore green is wind and half is solar, and floating wind has 20% lower LCOE than fixed offshore wind by 2050, green, yellow and pink hydrogen production could grow five-fold by 2050 (from 72 to 280 million metric tonnes/year).

What power source(s) will be used? By 2050, according to DNV, fixed onshore wind, fixed offshore wind, and solar are still expected to be less expensive power sources than floating wind, and it’s likely that the estimates don’t include the full cost of local supply chains, decommissioning costs, and recycling. This puts a strong burden on floating offshore wind to bring costs down – by more than 70% in the total levelized cost.

Unfortunately, experience in the oil & gas industry would indicate that a 70% reduction in overall LCOE is unrealistic. Improvements of this order of magnitude are sometimes seen in lead times (for example, BP reduced design hours of offshore platforms by 80%), inventory (many oil and gas and power companies lower inventory 30-50% in a category).

Bringing down overall LCOE by 75% would require every aspect of capex and opex to fall by 75%, which is unheard of. Success stories in standardization feature 10-20% savings at Shell (cable and valves) and 30% savings at Equinor (subsea equipment).

Savings from global sourcing and supply chain optimization have reached 13% in overall LCOE at one of the largest North Sea offshore wind farms, and 20-25% at power production operations at a subsidiary of a major global power company. A Latin American oil & gas company realized 24% savings on selected categories of equipment. A multi-year optimization study at a GCC oil & gas company achieved 1.4% reduction in Total Corporate Operating Cost and 6.7% in Total Corporate Return on Assets. A cost reduction effort at a Russian LNG facility brought capex down by 15%.

Suffice to say that bringing down all costs in the value chain by over 70% is a monumental challenge.

In addition to the challenge of lowering the LCOE of floating wind, floating-wind-to-green-hydrogen faces technical cost and efficiency challenges. For example (and some of these are additive, depending on the configuration):

- If converting to hydrogen via an electrolyzer offshore (“power to hydrogen”) for reconversion to electric power onshore (via fuel cells), there would be a large loss in double conversion: 64% efficiency in electrolysis x 50% efficiency in fuel cell operation = 32% efficiency, compared to about 70% efficiency for steam reforming, and by contrast to all of these permutations, burning natural gas to generate electricity is about 45% efficient.

- If piping hydrogen to shore, the cost to lay the pipe must be added.

- If power-to-hydrogen offshore, desalination is required to provide pure water for the electrolyzer.

- If fueling tankers with hydrogen produced offshore by electrolyzers, the same reconversion loss occurs as with exporting power to shore – efficiency loss during electrolysis, and a second efficiency loss during use in fuel cells onshore.

While floating wind may face challenges for large-scale hydrogen production, it is an efficient way to power offshore floating assets such as drilling rigs and production platforms, to capture excess or curtailed power, or both.

Floating Power Plant is using offshore wind turbine to power oil and gas production platforms. Excess power goes to battery storage, which is used to power the electrolyzer to produce hydrogen, and the hydrogen is piped to shore. When used to capture curtailed power after the grid power requirement is satisfied, it can be justified on an incremental cost basis.

The economics of DORIS Engineering’ NereHydT Combined Power and H2 Production demonstration project, in conjunction with Lhyfe, may provide a useful example of cost and design configurations of floating green hydrogen production as an ancillary feature of floating windfarm that is used primarily for electric power generation.

About the author: David Steven Jacoby is the President of Boston Strategies International, a consultancy dedicated to helping Global 1000 companies build high-performing, carbon-neutral supply chains through digitalization, data analytics, and clean energy technologies. He also founded a SaaS solution provider that helps energy and industrial companies accelerate their transition to net zero.

He is an Adjunct Professor of Operations Management at New York University's Tandon School of Engineering, a Senior Fellow at Boston University's Institute for Sustainable Energy, and a former adjunct professor at Boston University's Questrom Graduate School of Business. He wrote Guide to Supply Chain Management for The Economist, Reinventing the Energy Value Chain for PennWell Books, and four other books.

Footnotes

About the Author

David Steven Jacoby, President, Boston Strategies International

David Steven Jacoby is the President of Boston Strategies International, a consultancy dedicated to helping Global 1000 companies build high-performing, carbon-neutral supply chains through digitalization, data analytics, and clean energy technologies. He also founded a SaaS solution provider that helps energy and industrial companies accelerate their transition to net zero.

He is an Adjunct Professor of Operations Management at New York Universities Tandon School of Engineering, a Senior Fellow at Boston University's Institute for Sustainable Energy and a former adjunct professor at BU's Questrom Graduate School of Business. He wrote Guide to Supply Chain Management for the Economist, Reinventing the Energy Value Chain for Pennwell Books and four other books.