U.S. Charges Ahead: Energy Storage grows by 1 GW/3 GWh during 2022's final quarter

If only the U.S. stock trading powered forward like energy storage in the later, weak stages of 2022 and early this year. It'd be considered a bull market.

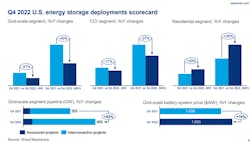

Domestic battery storage installations added 1,067 MW (1 GW) of capacity and 3.03 GWh of duration capability in the fourth quarter, according to the new report from research firm Wood Mackenzie Power & Renewables and partner American Clean Power Association. These totals are the fifth highest for any quarter on record in terms of MW installed, the Energy Storage Monitor quarterly report noted.

During a time when the stock market was giving up value as inflation roared, the U.S. residential battery storage sector racked up another record quarter at 171 MW/428 MWh installed, beating a 2021 quarterly mark by 17 MW, according to Wood Mackenzie & ACPA. The capacity grew every quarter in 2022, which reflects a “sustained demand for residential backup power and resiliency,” the report says.

These rosy achievements for residential battery storage installations offset a decline in utility or grid-scale project capacity at a still robust 848 MW. The grid-scale number was strong by most comparisons except for comparison with the previous two quarters which both saw installation totals over 1 GW each, according to the monitor report.

The commercial and industrial segments installed 48 MW/96 MWh during the fourth quarter, nearly doubling the project completion of a somewhat slower third quarter 2022, the report shows.

One battery storage developer, ESS Inc., announced at least five major projects in 2022 and early 2023 for its long-duration iron flow battery systems. Oregon-based ESS was contracted by such customers as Consumers Energy, Burbank Water and Power and Portland (Ore.) General Electric, among others.

North Carolina startup FlexGen also delivered on several battery storage projects with customers such as Middle River Power during 2022.

The supply chain should loosen and flow considerably in coming years as numerous companies have announced plans to locate gigafactory manufacturing facilities in the U.S. Many of these are making electric vehicle batteries or components, but larger-scale energy storage firms like Fluence and FREYR are locating manufacturing plants tighter within the North American market.

Wood Mackenzie delivered the forecasts and lower cost predictions for the future. The American Clean Power Association partners in producing the report on recent past installations, but does not participate in market forecasts.

Incentives promised by the federal Inflation Reduction Act could spur greater growth in C&I energy storage, solar and microgrid deployment, but those projects are still partially dependent on state incentives, local programs and standalone viability in particular areas.

The residential, rooftop solar segment continues to soar with more than 2.7 GW in residential energy storage installations predicted to pair with the renewables by 2027, according to Wood Mackenzie.

Another report by the Solar Energy Industries Association released earlier this month estimated that the commercial sector added about 1.4 GW in on-site solar capacity last year, a slight decrease from 2021. Projects delayed in 2022, however, should get the go-ahead this year and boost those figures.

And many energy managers at these sites will pair the solar with battery storage to smooth out some of intermittency of daylight photovoltaic power.

-- -- --

(Rod Walton, senior editor for EnergyTech, is a 15-year veteran of covering the energy industry both as a newspaper and trade journalist. He can be reached at [email protected]).

Follow us on Twitter @EnergyTechNews_ and @rodwaltonelp and on LinkedIn

About the Author

Rod Walton, EnergyTech Managing Editor

Managing Editor

For EnergyTech editorial inquiries, please contact Managing Editor Rod Walton at [email protected].

Rod Walton has spent 17 years covering the energy industry as a newspaper and trade journalist. He formerly was energy writer and business editor at the Tulsa World. Later, he spent six years covering the electricity power sector for Pennwell and Clarion Events. He joined Endeavor and EnergyTech in November 2021.

Walton earned his Bachelors degree in journalism from the University of Oklahoma. His career stops include the Moore American, Bartlesville Examiner-Enterprise, Wagoner Tribune and Tulsa World.

EnergyTech is focused on the mission critical and large-scale energy users and their sustainability and resiliency goals. These include the commercial and industrial sectors, as well as the military, universities, data centers and microgrids. The C&I sectors together account for close to 30 percent of greenhouse gas emissions in the U.S.

He was named Managing Editor for Microgrid Knowledge and EnergyTech starting July 1, 2023

Many large-scale energy users such as Fortune 500 companies, and mission-critical users such as military bases, universities, healthcare facilities, public safety and data centers, shifting their energy priorities to reach net-zero carbon goals within the coming decades. These include plans for renewable energy power purchase agreements, but also on-site resiliency projects such as microgrids, combined heat and power, rooftop solar, energy storage, digitalization and building efficiency upgrades.