What in the World Happened at RE+? The Lights are Bright and Renewables are Ready

LAS VEGAS—The best visual metaphor for the massive RE+ energy conference was orbiting only a few blocks away from the Venetian Resort where most of the event action happened this week.

The Sphere. Perhaps you’ve seen it either walking the Vegas strip, watching some video of it on YouTube or even going to see U2, Eagles or The Wizard of Oz within its mega-LED magnificence.

This technologically stunning marvel silently and brilliantly captures what drives the thought leadership around renewables and the energy transition at RE+. What's it saying?

The world is waiting, the world is difficult, the world is our oyster, and the world will make it happen. No worries and enjoy the show.

Come again? Now that I’ve lost you somewhat, dear reader, let me bring us back to the key themes which emerged during my time attending one of the world’s biggest energy conferences:

Times are Tough, Times are Good, and the Future is So Bright We’re Going to Need Shades

Yes, the second Trump Administration has erected some new barriers for the renewable and distributed energy sector. Tax credits and other incentives are sun-setting, stop-work orders are being enforced on projects nearly completed and the party in power is all about the centralized power plant, be it gas-fired or nuclear.

Well, say the renewable glitterati at RE+: Time and free market economics are our side. Most of those gas or nuclear plants won’t be completed until the next presidence and in the meantime we will need most of the above to meet unprecedented pace of growth in data, AI, industrialization and electrification.

“Technology wins,” said Brian Nelson, renewable segment leader at Swiss-based energy technology giant ABB. “Technology will continue to push the evolution of renewable energy further and further.”

On a purely company level, Nelson highlighted the rise of new 2,000-volt capacity for solar energy collection, pushing module capabilities higher and energy denser than ever.

The aging utility grid, the marvel of engineering that it is, was built for an earlier, one-directional era and is not completely prepared for what’s ahead. The utility grid is amazing and certainly relevant, but to upgrade it will require innovation and installation at the edge of the grid for multiple reasons.

The interconnection queue is not a fun line to join

“You can’t build a transmission line, as it’s so difficult” on both financial and public approval levels, Nelson said. “We’re going to be forced to be more distributive.”

This free market inevitability, as some may call it, is strengthened by the fact that solar and battery storage continue to fall in price, while also being easier and quicker to deploy by multiple years compared with natural gas and nuclear power.

Price signals are the key to driving the momentum of solar and storage adoption. A string of records in annual installed capacity will probably be broken this year, but the favorable economics and logistics around solar-storage deployment should sustain the positive pace forward.

“Ultimately the thing that should be communicated to people are price signals,” Jesse Peltan, founder and CEO of Type 1 and a social media leader with the renewables sector, said during a session at the Venetian. “We do not have an accurate value for all sorts of technologies. . . Price is the thing that’s going to speak loudest.”

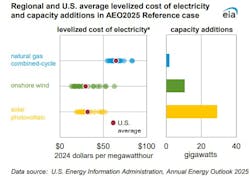

An April report by the U.S. Energy Information Administration on the levelized cost of electricity found that solar photovoltaic and onshore wind were cheaper per MWh than natural gas combined-cycle, and that’s certainly the case vs. nuclear fission. Solar totaled close to 30 GW of new capacity, multiple times more than new gas-fired power, according to the EIA.

Combine that with batteries—particularly lithium-ion—and the growth trajectory promises not to slow down much. In fact, the solar-storage equation could change everything.

“We could expand total generation 20% in one year with energy storage,” Peltan said. “That’s not building any new thermal generation, and we can get (batteries) online immediately.”

Higher calling is happening right in front of our eyes

Speed of deployment is solar’s calling card these days. Solar panels are going to get bigger and cheaper because, well, the skies are the limit.

“If God wanted a Type 1 civilization he would have...,” Peltan rhetorically asked in a popular X tweet a while back: “1) Put a giant fusion reactor in the sky; 2) Made 28% of Earth’s crust out of a semiconductor with a matching bandgap; 3) Filled the oceans with an alkali metal we could use to store limitless quantities of energy. . .

“That would be a crazy coincidence.”

Insane to the brain for many, but not for those at RE+. Many of renewable’s true believers are adapting, even acknowledging the heresy that meeting future data center demand may require nearly all kind of energy, including natural gas.

But they are not ceding their territory despite the coming end of tax credits and onslaught of withdrawn permitting. Solar’s rise will not be stopped and with its best friend energy storage joining forces it may end up winning, after all.

For Cherry Street Energy founder Michael Chanin, the proof is all around us. His company has explored the capacity of rooftop and canopy solar on the built environment of metro Atlanta, which offers potential multiple gigawatts of capacity to both provide distributed energy and grid services in the era of rising data center consumption.

“Distributed energy is not a panacea but a material help,” Chanin pointed out at RE+. “This technology has reached the point of commercialization. That’s become clearer, and that technology is now accessible and available at a pace which is the most capital efficient and quickest to serve at the place it’s needed the most.”

The sphere of influence which revolves around business cases proven and value propositions realized attracted developers, manufacturers, builders and private equity funders to RE+. They believe the world is changing, and brightly so for solar and renewables.